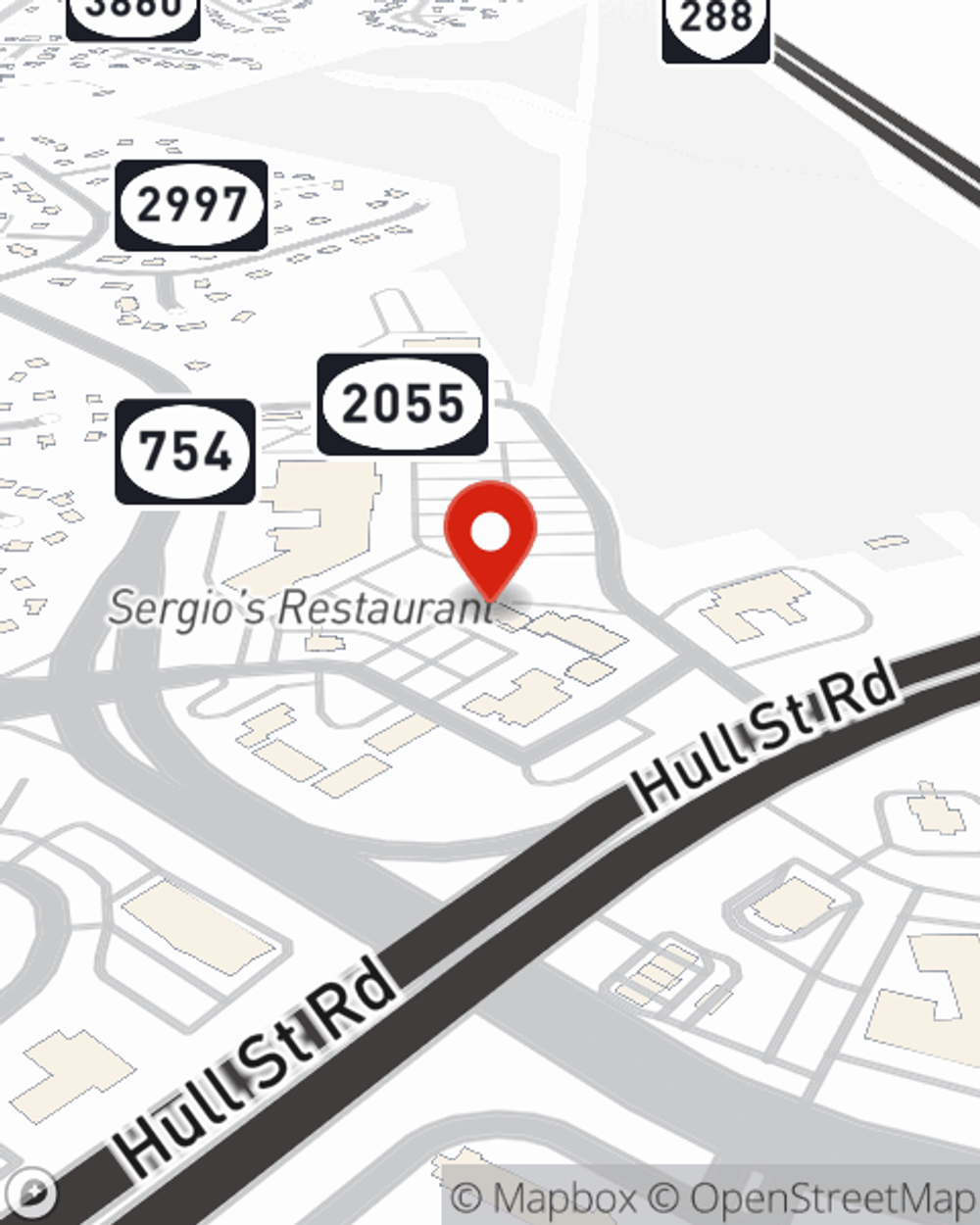

Condo Insurance in and around Midlothian

Townhome owners of Midlothian, State Farm has you covered.

Protect your condo the smart way

- Midlothian

- Richmond

- Amelia

- Chesterfield

Home Is Where Your Condo Is

When it's time to unwind, the safe place that comes to mind for you and your loved onesis your condo.

Townhome owners of Midlothian, State Farm has you covered.

Protect your condo the smart way

Safeguard Your Greatest Asset

We understand. That's why State Farm offers awesome Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Chris Smith is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that provides what you need.

Insuring your condo with State Farm can be the right thing to do for your home, your loved ones, and your belongings. Reach out to Chris Smith's office today to discover how you can benefit from Condo Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Chris at (804) 744-1227 or visit our FAQ page.

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Chris Smith

State Farm® Insurance AgentSimple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.